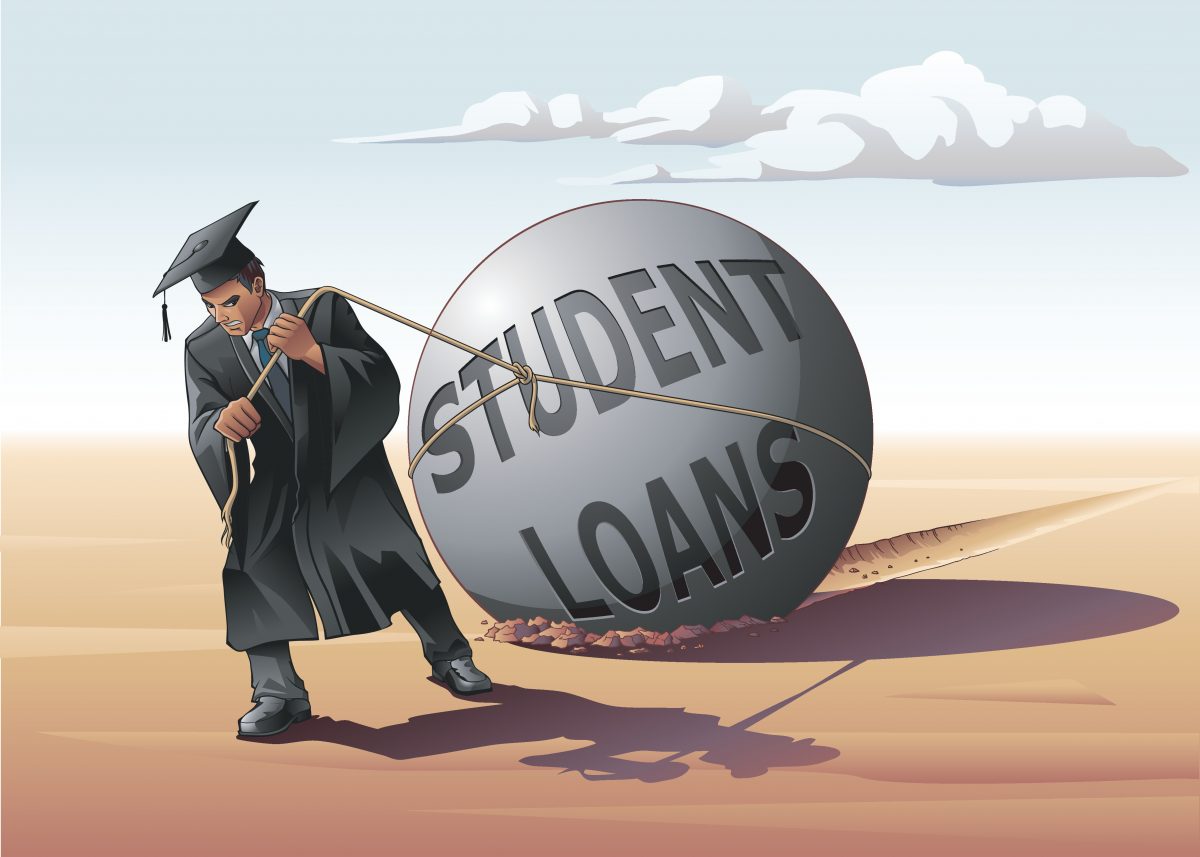

Today, we will take a look at some method on how to pay off student loans faster, allowing you to regain access to your financial freedom. You can unlock new opportunities and create the path to a debt-free life by using strategies sooner than you ever imagined.

What Is a Student Loan?

A student loan is a type of financial aid given to students to help pay for expenses like tuition, books, and living costs related to higher education. It is borrowed money that must be repaid over a predetermined period, along with interest. Government agencies as well as private lenders offer student loans, and the terms and conditions change depending on the lender.

These loans often play a significant role in making college or university education accessible to a wider range of people. They are designed to help students pursue their educational goals.

Tips to Pay Off Student Loans Faster

For millions of people pursuing higher education, student loans are a common reality. The burden of loan repayment can cast a shadow on one’s financial future as the post-graduation glow fades. However, you can take charge of your student loans and speed up the repayment process by adopting a strategic and proactive approach.

Let’s look at some efficient methods and advice for paying off student loans quickly so you can achieve financial independence and follow your dreams without being constrained by debt.

Make A Thorough Budget and Keep Track of Your Expenses

Understanding your financial situation is the first step to paying off your student loans more quickly. Start by putting together a detailed budget that lists all of your income, expenses, and debts. Examine your spending patterns carefully to find areas where you can save money or make changes. You can increase the amount you have available to put toward loan repayment and hasten the process by keeping meticulous records of your spending.

Make Extra Payments Whenever Possible

Making extra payments whenever you can is one of the most efficient ways to hasten the repayment of your student loans. Any additional funds, such as tax returns, bonuses, or freelance earnings, should be put toward your loan payments. You can eventually lower the principal balance and pay less interest by consistently making extra payments. Make sure these extra payments are applied correctly and specifically state that they should go toward the principal by getting in touch with your loan servicer.

Make More Payments Each Month

Increasing your monthly payments is one of the best ways to pay off student loans more quickly. In the long run, even a small increase in your monthly contribution can have a big impact. Instead of the usual monthly payments, think about setting up automatic payments or making payments every two weeks. By doing this, you’ll pay off your loan faster and with less interest by making 13 full payments in a year as opposed to the standard 12 payments.

Consider Refinancing Your Loan

Student loan refinancing is a potent tool for reducing interest rates and saving money. You might be able to refinance your loans with a private lender at a lower interest rate if you have good credit and a consistent income. You can combine your existing loans into a single loan with better terms by refinancing. Be cautious, though, as refinancing federal loans could result in the loss of certain advantages, such as income-driven repayment plans or loan forgiveness programs.

Explore Income-Driven Repayment plans

Borrowers who are having trouble making their monthly loan payments may find some relief from income-driven repayment plans. These plans determine your monthly payment based on your income and the size of your family, keeping the payments within reach. Income-driven plans can be helpful if you are having financial difficulties, even though they may lengthen the repayment period. Understanding the eligibility requirements and potential long-term effects of these plans is essential.

Look for Additional Income sources

Consider looking into additional sources of income to hasten the repayment of your debt. This could involve starting a side business, freelancing, or getting a part-time job. You can directly apply the extra money you make from these endeavors to your student loans, which will speed up the repayment process. To prevent burnout, make sure to maintain a balance between your personal and professional lives.

Explore Programs for Loan Forgiveness

You may be qualified for loan forgiveness programs if you’re working toward a career in the public sector or one of several other professions. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining loan balance for borrowers who hold eligible public service jobs after 120 qualifying payments. To make the most of these programs, become familiar with and understand their requirements.

Stay Motivated and Remain consistent

Fast student loan repayment requires determination and resolve. It’s important to maintain motivation throughout the process by picturing the opportunities and financial freedom that will be yours once the loans are paid off. Celebrate minor accomplishments along the way, such as paying off a particular loan or reaching a particular repayment percentage. To stay on track, surround yourself with a helpful network and look for advice from financial advisors or online communities.

Frequently Asked Questions

Should I Focus On Paying Off High-Interest Student Loans First?

Yes, it is generally a good idea to pay off your student loans with the highest interest rate first. You can save money in the long run by concentrating on these loans and lowering the amount of interest that accrues. Early repayment of high-interest loans can also speed up the overall repayment process by freeing up more money to apply to other loans.

Is It Possible to Negotiate or Lower the Interest Rate On My Student Loan?

Since the government sets the interest rates, it is impossible to negotiate or lower them for federal student loans. To get a lower interest rate, you might be able to refinance private student loans. Refinancing involves taking out a fresh loan from a private lender to pay off your current debts, which could result in a lower interest rate and save you money over time.

Can I Contribute More to My Student Loans?

Yes, increasing your student loan payments is a great way to get them paid off faster. You can lower the principal balance and, as a result, the amount of interest charged by making additional payments. It’s crucial to check with your loan servicer to make sure that any additional payments are applied properly and that they are designated for the principal.

Are There Any Forgiveness Programs for Student Loans?

Yes, there are programs for certain student loan types that offer forgiveness. Under the Public Service Loan Forgiveness (PSLF) program, borrowers who work full-time in eligible public service positions and make 120 eligible payments are eligible to have their remaining loan balances forgiven.

Additionally, there may be loan forgiveness options available through specific programs for some professions, including teaching, nursing, and medicine. It’s important to look into, understand, and meet the requirements for each forgiveness program.