What is mortgage refinancing, and how does it work? If you’re curious about this process, you’re in the right place – everything you need to understand about mortgage refinancing is covered in this article. Just read on.

When you engage in mortgage refinancing, you essentially replace your existing mortgage with a new one, complete with altered terms and rates. This process allows you to change your lender and even the type of loan you have.

However, keep in mind that if you plan to refinance your mortgage, you’ll need to cover closing costs, typically ranging from 2% to 5% of the loan amount. It’s crucial to calculate and analyze your break-even point when refinancing to save money.

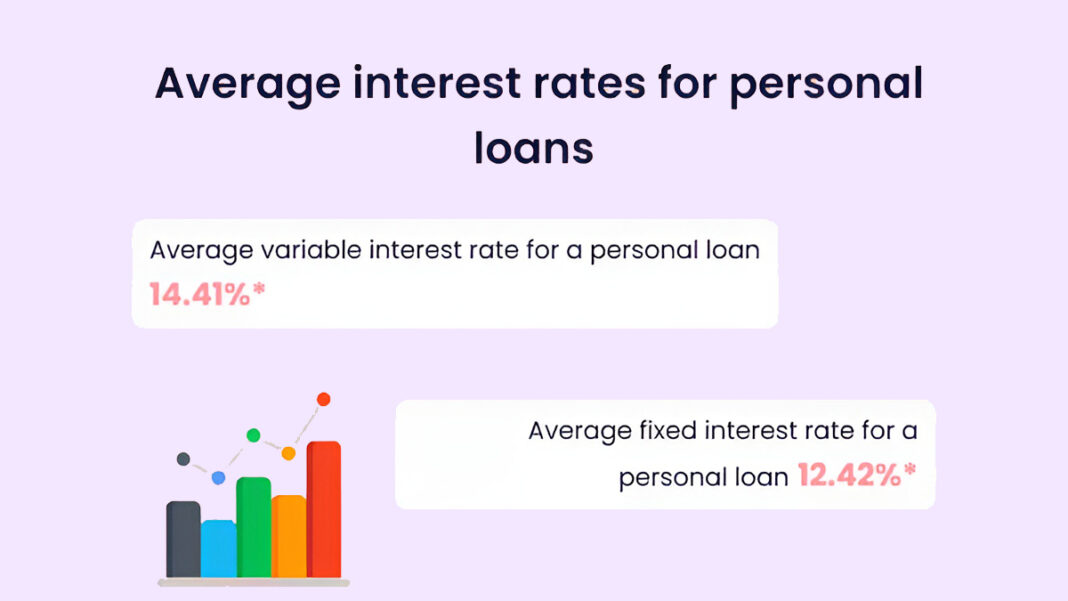

Additionally, mortgage rates are subject to constant change and are anticipated to be higher in 2023, making it less favorable to replace your old loan with a new mortgage. However, should the need for refinancing arise, you can always revisit this content for reference.

What Is Mortgage Refinancing?

Mortgage refinancing involves swapping your old mortgage for a new one with different terms and interest rates.

The new mortgage pays off the old one, leaving you with a single mortgage featuring improved terms and rates compared to the original.

Many individuals wonder how often they can refinance their mortgage. The answer is, there’s no set limit to the number of times you can refinance your loan.

Types of Mortgage Refinance

There are various types of mortgage refinancing and these types have their purposes and features that they offer. They include:

- Cash-out refinance.

- Streamline refinance.

- Rate-and-term refinance.

- Short refinance.

- Debt consolidation refinance.

- No-closing-cost refinance.

- Cash-in refinance.

- Reverse mortgage.

So, based on what your mortgage is for, you can be able to find out what type of mortgage refinancing you need.

How Does It Work?

Mortgage refinancing is the straightforward process of replacing an old mortgage with a new one. To initiate this, you’ll undergo a credit check and apply, much like your initial mortgage application. Required documents include proof of identity and income.

It’s important to note that the new mortgage refinancing may offer better terms than the old one. You could potentially receive a lump sum of cash, benefit from a lower interest rate, and opt for a shorter loan repayment term.

However, keep in mind that mortgage refinancing comes with fees and additional costs, so any savings you gain will be used to cover these expenses.

Is Mortgage Refinancing Worth It?

Yes, giving mortgage refinancing a try is worthwhile, and there are numerous benefits to enjoy. As mentioned earlier, one of the key advantages is securing a lower interest rate, even if you have a low or improving credit score.

Furthermore, engaging in mortgage refinancing allows you to explore different loan types and leverage your home equity to access additional funds. Equally significant, this process empowers borrowers to shorten the lifespan of their loans, paving the way for long-term savings opportunities.

How To Refinance Your Mortgage

No matter what mortgage you would like to refinance, the procedure is very similar to the mortgage application and purchase procedure.

But keep in mind that the lender will check out your finances, find out your eligibility, and check out your risk level. Here is what you need to do to refinance your mortgage:

- Settle on a Lucid Financial Target.

- Examine your Credit History and Score.

- Find Out How Much Home Equity You Have.

- Check and Shop from Different Mortgage Lenders.

- Complete Paperwork.

- Prepare for Home Assessment.

- Close with Cash and Follow Up on Your Loan.

Settle On Lucid Financial Target

When you are refinancing a mortgage, you must settle on a clean financial target. For instance, if you want to decrease your loan term or monthly payment, there should be a purpose for your mortgage refinancing.

Examine Your Credit History And Score

Secondly, check your credit score and history. This is because you need to be qualified for this process before your mortgage refinancing will be approved. Besides, if you have a high credit score, the higher your chances of better refinance rates.

Find Out How Much Home Equity You Have

Another way to refinance your mortgage is to research how much home equity you have. This is about checking the whole value of your home minus your mortgage debts. You can also check your newest mortgage statement to find out.

Check And Shop From Different Mortgage Lenders

When remortgaging, you must check out and compare the rates of other lenders before purchasing. This process is very important.

What’s more, if you purchase quotes from two or three different lenders, you can increase your savings.

Complete Paperwork

Next, complete the necessary paperwork and provide all the relevant documents required for this process.

However, make sure that your brokerage or bank statement, recent pay stubs, and federal tax returns are accurate

Prepare For Home Assessment

To be able to successfully refinance a mortgage, especially for homes, you will need to under home assessment. There are also a lot of factors to consider during this process.

Close With Cash And Follow Up On Your Loan

Finally, complete the last steps in your loan and mortgage refinancing process and stay on top of your loan.

Remember to keep copies of all your paperwork. Additionally, if you opt for AutoPay, you may be eligible for lower interest rates from lenders.