Managing your finances can be a complex and overwhelming task. Whether you’re planning for retirement, saving for a child’s education, or simply trying to grow your wealth, seeking the guidance of a financial advisor can make a significant difference.

However, finding the right advisor for your specific needs can be a daunting process. In this step-by-step guide, we will walk you through the considerations and necessary steps to choose the right financial advisor.

Step 1: Identify Your Goals and Needs

Before approaching any financial advisor, you must first clarify your financial goals and needs. Consider what you hope to achieve, be it long-term financial security, debt reduction, or investment growth. Ensure that your goals align with your financial advisor’s expertise.

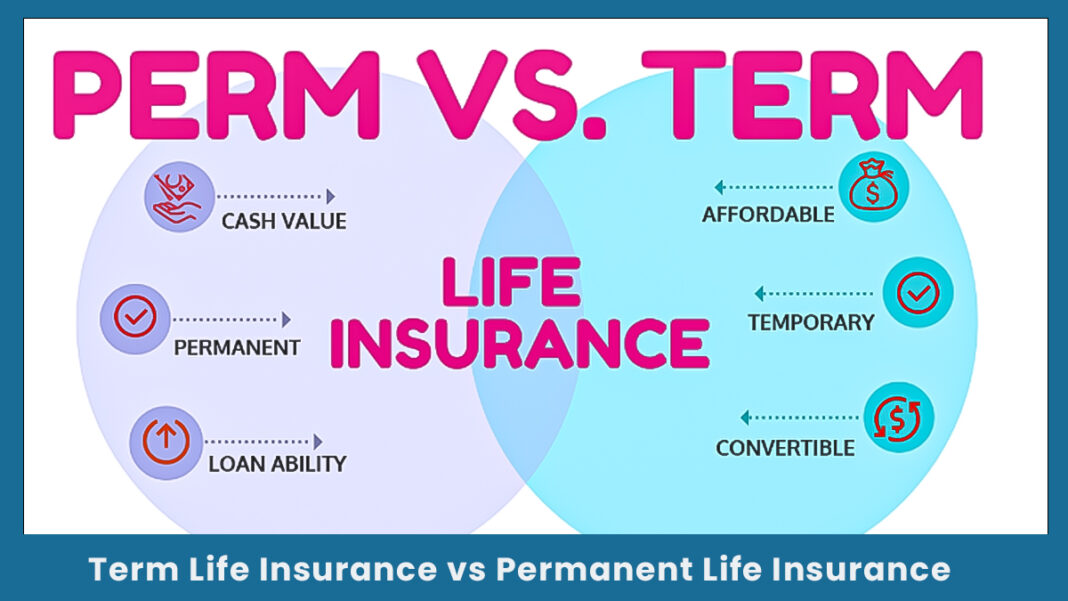

Step 2: Research Different Types of Advisors

There are various types of financial advisors, each specializing in different areas. Some focus on retirement planning, while others excel in tax strategies or investment management. Understanding the different types of advisors will help you identify which ones are best suited to your needs.

Step 3: Check Credentials and Certifications

When it comes to your finances, working with a qualified professional is crucial. Look for advisors who hold certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Chartered Financial Consultant (ChFC). These certifications reflect a certain level of knowledge and expertise.

Step 4: Verify Experience and Track Record

Experience matters in the financial advising industry. Look for advisors who have been in the field for a significant amount of time and have a proven track record of helping clients like you achieve their financial goals. Don’t hesitate to ask for references or client testimonials to ensure that the advisor’s expertise aligns with your needs.

Step 5: Understand the Advisor’s Compensation Structure

Financial advisors might be compensated in various ways. Some earn a commission based on the products they sell, while others charge a fee based on the assets under management. Make sure you understand how the advisor is compensated, as this can impact their advice and potentially create conflicts of interest.

Step 6: Research the Advisor’s Regulatory History

It is essential to check whether the advisor has any disciplinary actions or complaints lodged against them. You can do this by verifying their registration with regulatory bodies such as the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or state securities agencies. This step ensures you are entrusting your finances to a trustworthy individual.

Step 7: Schedule an Initial Consultation

Once you have narrowed down your options, schedule an initial consultation with each prospective advisor. Use this opportunity to get a sense of their communication style, understanding of your goals, and their proposed strategies. Pay attention to how they listen, ask questions, and tailor their advice to your specific situation.

Step 8: Evaluate the Chemistry

Building a successful relationship with your financial advisor requires trust and open communication. Evaluate whether you feel comfortable discussing personal matters and entrusting the advisor with your financial affairs. Trust your instincts in determining whether the chemistry between both parties is conducive to a productive partnership.

Step 9: Review and Sign the Advisor’s Agreement

If you feel confident in your choice, it’s time to thoroughly review and sign the financial advisor’s agreement. Ensure that all services, fees, and expectations are clearly articulated in the agreement. Seek professional advice if you need further clarification on any aspects of the agreement.

Step 10: Regularly Review and Evaluate the Relationship

After engaging a financial advisor, continue to monitor and evaluate the performance of your investments or the progress towards your goals. Maintain an open line of communication with your advisor and review your plan as your circumstances evolve. Regular check-ins will help ensure that your financial plans remain on track.

Choosing the right financial advisor is an important decision that can have a significant impact on your financial future. By following this step-by-step guide, you will be well-equipped to find a qualified and trustworthy advisor who can assist you in achieving your financial goals. Remember, it’s your money, and taking the time to find the right advisor is worth the effort.