Do you know what it feels like when you suddenly realize you can’t find your Opay ATM card anywhere? Could it be hidden somewhere close at hand, or has it been taken by thieving hands?

This feeling of powerlessness is far too familiar, isn’t it? Financial security is far more important than the inanimate object in your wallet. A missing card? The situation is critical. You may be worried about your potential financial loss, irregular transactions and privacy problems with personal Information.

No problem; this we guide is going to benefit you. The simple blocked process is outlined below and we hope to remain a positive influence on your investment.

Why You Should Block Your Opay ATM Card Immediately

Before we get into the ‘how’, let’s quickly review the ‘why’. Here are the crucial reasons to block your Opay ATM card without delay:

- Prevent Fraudulent Activity: Immediate blocking stops unauthorized transactions and potential financial losses if your card is lost or stolen.

- Enhanced Security: Blocking offers extra protection in case of security breaches or suspected card information compromise.

- Stop Ongoing Fraud: If you notice any transactions you didn’t make, blocking your card is essential to prevent further unauthorized activity.

- Identity Theft Protection: Swift action helps prevent identity theft and protects your account from scams.

- Peace of Mind: Blocking your card promptly reduces risks and safeguards your money, especially if you receive alerts about suspicious card activity.

Now that you understand the importance, let’s look at how to block your Opay ATM card.

The Opay ATM Card Blocking Code: Your First Line of Defense

Opay has made it incredibly simple to block your ATM card. All you need is a simple USSD code:

*955*132#

This handy code allows you to quickly secure your card in case of theft, loss, or any security concerns. Let’s walk through the process step-by-step.

How to Block Your Opay ATM Card: A Step-by-Step Guide

Follow these simple steps to block your Opay ATM card using the USSD code:

- Dial *955*132#** on your mobile phone.

- You’ll receive a prompt to confirm blocking your ATM card.

- Enter your 4-digit USSD PIN to proceed.

- Wait for a confirmation message on your phone stating that your ATM card has been successfully blocked.

Additionally, Opay will send you an SMS confirming the card blocking.

It’s that simple! Your card is now blocked, preventing any unauthorized access to your account.

Alternative Methods for Blocking Opay ATM Cards

While the USSD code is the quickest method, Opay offers other options to block your ATM card:

- Contact Opay Customer Service:

- Call their helpline

- Send an email

- Visit an Opay branch in person

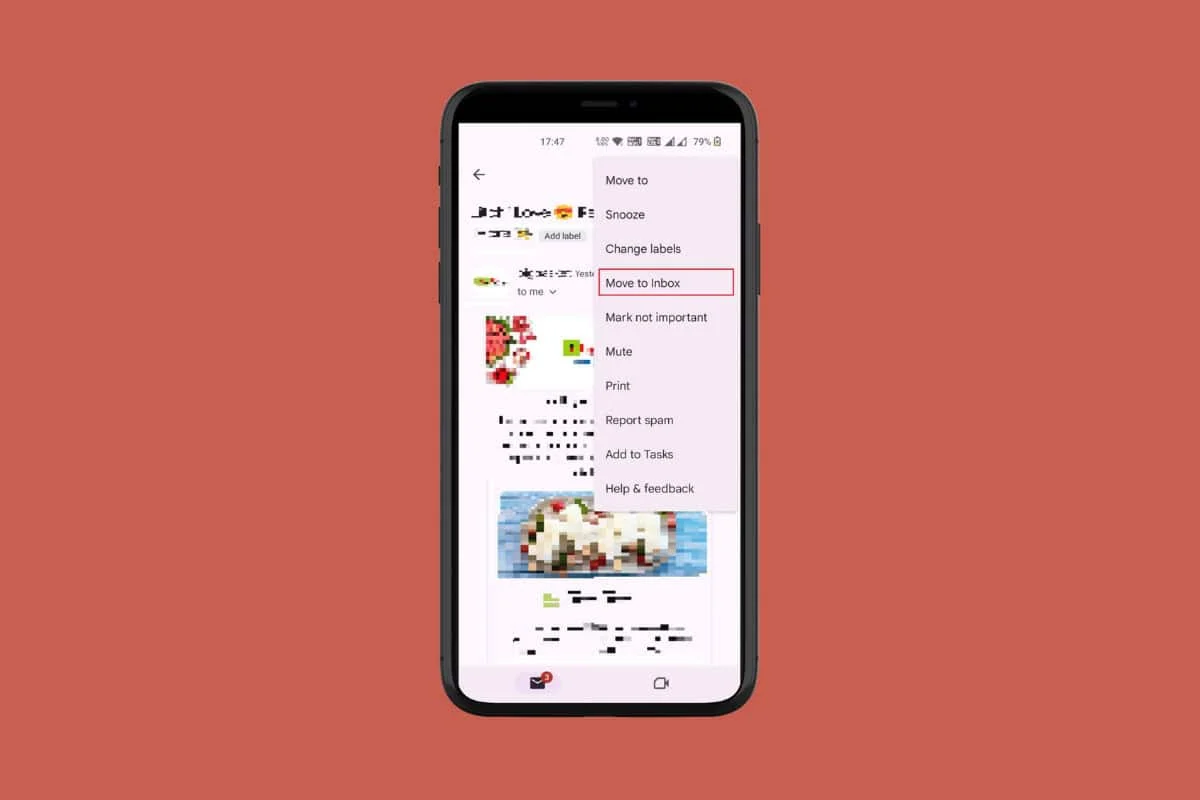

2. Use the Opay Mobile App:

- Log into your Opay app

- Navigate to the card management section

- Select the option to block your card

Choose the method that’s most convenient for you, but remember – speed is crucial when it comes to protecting your finances.

Frequently Asked Questions About Blocking Opay ATM Cards

To address any lingering concerns, here are some common questions about blocking Opay ATM cards:

Q: What should I do if I can’t remember the USSD code to block my Opay ATM card?

A: Don’t worry! You can always contact Opay customer service for assistance. They’re available 24/7 to help secure your account.

Q: How quickly does the card blocking take effect after using the USSD code?

A: The blocking is almost instantaneous. Once you complete the process, your card will be unusable for any transactions.

Q: Can I unblock my Opay ATM card if I find it after blocking?

A: Yes, but you’ll need to contact Opay customer service. They’ll verify your identity and help you unblock the card or issue a new one, depending on the circumstances.

Q: Will blocking my ATM card affect my Opay account balance or other services?

A: No, blocking your card only prevents transactions using that specific card. Your account balance and other Opay services remain unaffected.

Q: Are there any fees for blocking my Opay ATM card?

A: Opay does not charge any fees for blocking your card. It’s a free service to ensure your financial security.

Protecting Your Opay Account: Beyond Card Blocking

While knowing how to block your card is crucial, here are some additional tips to enhance your Opay account security:

- Regularly update your PIN and passwords

- Enable two-factor authentication if available

- Monitor your account activity frequently

- Never share your card details or PIN with anyone

- Avoid falling for email or SMS fraudulent messages.

In Summary: Your Financial Security is in Your Hands

Losing your Opay ATM card or suspecting it’s been stolen can be stressful, but taking immediate action to block the card is key to protecting your financial well-being. Whether you use the quick USSD code *955*132# or other methods offered by Opay, you now have the knowledge to swiftly secure your account and reduce the risk of financial loss.

Remember, in situations involving lost, stolen, or compromised cards, quick action is your best defense. Blocking your Opay ATM card offers numerous benefits, including protection from fraudulent transactions, prevention of potential financial loss, and ensuring a secure banking environment.

We hope this guide has equipped you with the information needed to take immediate action and effectively manage your financial security. If you have any additional questions, personal experiences you’d like to share, or suggestions for future topics, please feel free to leave a comment below. Your insights could provide valuable support to others facing similar situations.

Stay safe, stay secure, and take control of your financial future with Opay!