Purchasing OPay POS systems is something you should do as a business owner. It is crucial for all kinds of businesses. OPay is one of Nigeria’s top financial services companies. Offering a strong point-of-sale system. With this option, payments may be made more easily and your company can expand. You will be provided with instructions at every stage of this tutorial.

What is OPay, and why choose their POS machine?

OPay is one of the top financial technology providers. It offers the latest payment methods to individuals and businesses across Africa. OPay was founded in 2018. As a key factor in digital payment transactions, it has become increasingly important in recent years. It offers POS bill payments and mobile money services.

Benefits of Using an OPay POS Machine.

- With OPay’s secure system, transactions are faster, and outstanding uptime is guaranteed.

- OPay POS terminals accept many different payment types. Examples include debit cards, QR codes, and mobile payments.

- OPay charges reasonable fees. Compared to conventional banks, the fees are reduced. They are also cheaper than those of other fintech companies.

- The user interface of the OPay POS machine is user-friendly. Both users and customers will appreciate the ease of use.

- In just a few seconds, get the transaction report. retrieving transaction data and generating reports upon request. They assist in running your business more effectively.

OPay POS Machine Features and Specifications

OPay machines have numerous applications. The developers created these intentions to increase the success of your business.

- Accept debit cards, QR code payments, and OPay wallet payments.

- An integrated thermal printer enables receipts to be printed out immediately.

- It is a long-lasting battery that runs continuously for extended periods without the need for frequent charging.

- Wi-Fi and 4G connectivity: Ensure reliable connections for easy transactions.

- Large touchscreen with a user-friendly interface designed for both customers and businesses.

- Contactless card payments are supported by NFC functions.

- Transaction monitoring enables instant sales tracking and generates reports.

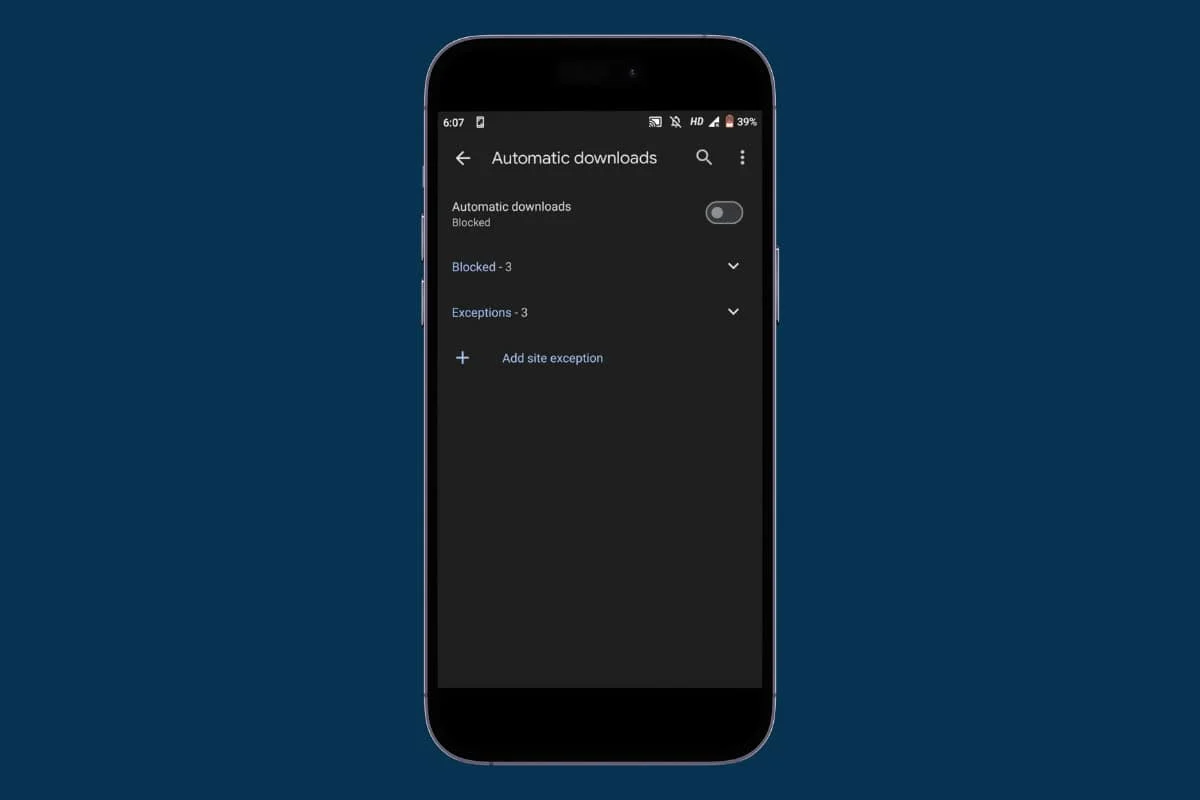

- Download updates automatically. They will provide you with security updates and the latest features.

Eligibility and Requirements for the OPay POS Machine

To be eligible for an OPay POS machine, you must meet the following requirements:

-

Having a registered business in Nigeria is required.

-

You must have an ID, like a national ID, driver’s licence, or passport.

-

You must Provide proof of business address (e.g., utility bill or tenancy agreement).

-

You must have a functional smartphone to download and use the OPay Merchant app.

-

Maintain a minimum number of transactions occurring each month.

OPay may have added or modified requirements based on current regulations and risk assessments. Always visit the official OPay website to check the latest criteria. Instead, ask an OPay agent.

How to apply for Opay Pos Machine

Follow these steps to apply to your OPay POS machine.

-

On your smartphone, visit the Apple Store or Google Play Store and download the “OPay Business App.“

-

Create an account If you don’t have an account yet, register. You will need to enter your phone number and provide some basic information about yourself.

-

Continue to the POS Applications section. After logging in, select the “Become a Merchant” or “Apply for POS” option from the app menu.

-

Complete the application form by providing all necessary information about your company. The section contains the company’s name, address, type of operation, and anticipated volume of transactions.

-

Upload the required information, such as copies of your proof of address, business registration documents, and ID card.

-

Finally, go through all the details you entered then Agree to the Terms and Conditions.

Waiting for approval: It will take three to five business days for OPay to approve your application. They may contact you if we require further information. Once it is fully approved, OPay will send it to your business address.

OPay Customer Support

OPay offers a variety of customer support options, including:

-

24/7 Helpline: For immediate assistance, call the dedicated dealer support number.

-

In-App Support: Access the Help Center directly from the OPay app or chat with a support representative.

-

Email Support: The support email address provided should be used to send detailed questions or supporting materials.

-

Use OPay’s official social media handles. General inquiries will be processed immediately.

-

Physical Support Centres: If you need in-person assistance, visit an OPay office in your city.

Note: Your transaction details and merchant ID should always be available. To solve problems more quickly, use this when contacting support.

This guide will help you get the most out of your OPay POS machine and ensure it is operating at maximum capacity. In the current economic climate, your business will thrive if you take advantage of the potential benefits of digital payments.