Choosing the right term life insurance is one of the most important financial decisions you can make for yourself and your loved ones. A solid term life insurance policy provides peace of mind, knowing that your family will be protected financially if the unexpected happens. However, with so many insurance companies on the market, it can be difficult to decide which one to choose.

To help you make an informed decision, we’ve compiled a comprehensive list of the top and best term life insurance companies. These companies stand out for their strong financial stability, excellent customer service, affordable premiums, and customizable policy options.

What is Term Life Insurance?

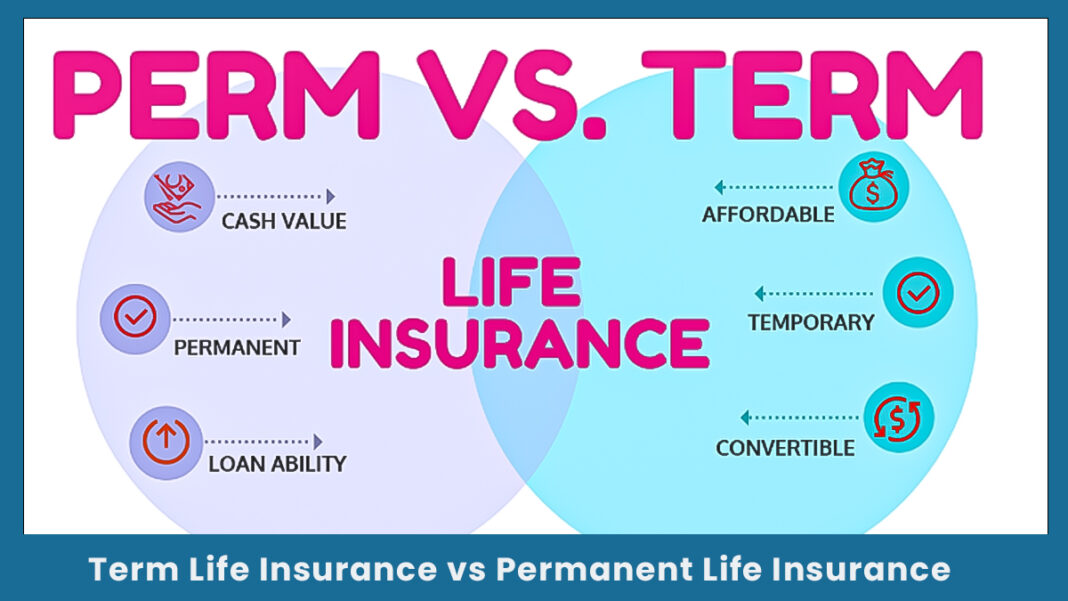

Term life insurance is a type of life insurance policy that provides coverage for a set period of time — typically 10, 15, 20, or 30 years. If the policyholder passes away during the term, the designated beneficiaries receive a tax-free death benefit. Unlike whole life insurance, term life insurance is more affordable and doesn’t include any cash value component.

Factors to Consider When Choosing a Term Life Insurance Company

Before we dive into our list, it’s essential to understand the key factors to consider when selecting the best term life insurance:

- Financial Strength: Look for companies with high ratings from agencies like A.M. Best, Moody’s, or S&P. This ensures the insurer can pay claims.

- Affordability: Compare quotes to find competitive premiums that fit your budget.

- Policy Options: Choose insurers offering flexible terms and customizable coverage.

- Customer Service: Opt for companies known for excellent customer service and a simple claims process.

- Online Experience: Some companies offer quick online quotes and digital policy management.

Top and The Best Term Life Insurance Companies

1. Haven Life

Haven Life, backed by MassMutual, offers a modern and digital-first approach to term life insurance. Their policies are affordable, application is fast, and many applicants can get coverage without a medical exam. It’s perfect for tech-savvy consumers seeking convenience.

Pros:

- Easy online application

- No-medical-exam option available

- Backed by MassMutual (A++ financial rating)

2. Banner Life

Banner Life, part of Legal & General America, is known for competitive rates and flexible coverage options. It offers term policies with terms up to 40 years — longer than most competitors.

Pros:

- Very competitive rates

- Terms up to 40 years

- Strong financial stability

3. Protective Life

Protective Life offers one of the most affordable term life insurance options on the market. They also provide a variety of riders for customization.

Pros:

- Low-cost premiums

- Strong customer service

- Multiple rider options

4. AIG

AIG offers term life policies with some of the most flexible features available. Their term coverage can often be converted into permanent life insurance without a medical exam.

Pros:

- Convertible policies

- Flexible coverage amounts

- Long-established reputation

5. State Farm

State Farm is well-known for its excellent customer service and financial strength. If you prefer to work with an agent, State Farm offers personalized assistance.

Pros:

- Exceptional customer service

- Financial stability

- Wide range of insurance products

6. Mutual of Omaha

Mutual of Omaha is a long-trusted name in life insurance. Their term policies are known for being affordable and straightforward.

Pros:

- Trusted brand

- Affordable policies

- Easy-to-understand terms

7. Pacific Life

Pacific Life stands out for flexible term life options and strong financial ratings. It’s a great option for those who might want to convert to permanent coverage later.

Pros:

- Convertible policies

- Excellent financial strength

- Flexible terms

Why Buy Term Life Insurance?

Term life insurance is an affordable way to secure your family’s future. It’s ideal for:

- Parents of young children

- Homeowners with a mortgage

- Anyone with dependents or debts

- Individuals looking for income replacement protection

By locking in a low premium now, you can protect your loved ones from financial hardship in the event of your passing.

Final Thoughts

Finding the right life insurance can seem overwhelming, but the top term life insurance companies listed above offer some of the best options on the market today. Be sure to compare quotes, evaluate your needs, and choose a company that aligns with your goals and budget.

Remember: the best policy is the one that provides your family with financial protection when they need it the most.