Commercial insurance, also referred to as business insurance, is a type of insurance that covers businesses from losses due to unforeseen events during business operations. These unforeseen events include natural disasters, lawsuits, and accidents. Commercial insurance comes in several types for business risks and balance.

Based on potential risks, businesses determine their commercial insurance needs. This varies based on the business type and its environment. However, this is important because business owners are required to properly determine and consider their business risks because they may face personal financial exposure if ever there is an event of a loss.

Commercial insurance shields business owners from unforeseen events they cannot cover themselves. With this insurance, businesses can operate even when it seems too risky to be done.

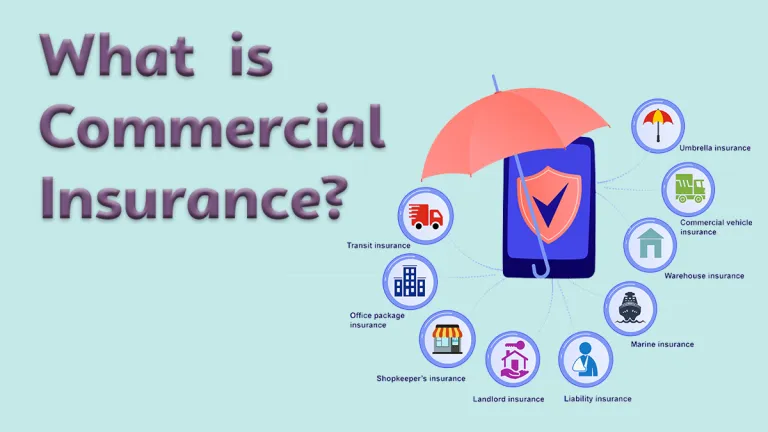

Types of Commercial Insurance Coverage?

According to federal regulations, certain types of commercial insurance coverage are mandatory for all businesses. One of these is workers’ compensation insurance coverage. It is also mandatory in some states for businesses to have additional coverage types.

However, it makes more sense for businesses to get other coverages that are not legally required for more protection. While we have this, the following are types of business insurance coverage:

• Commercial General Liability Insurance

Commercial general liability insurance is a type of insurance policy all businesses need. It is also referred to as comprehensive insurance. While it is important to take, it does not cover businesses against all risks. Instead, it covers property damage, libel, medical expenses, lawsuit defense, slander, and judgment settlements.

• Commercial Property Insurance

Commercial property insurance is tailored for businesses with remarkable physical properties. These properties include inventory, equipment, furniture, and signage. It covers businesses from losses due to theft, storm, or fire; it also covers damages due to properties like computers, signage, inventory, or furniture.

• Product Liability Insurance

Product liability insurance is made for businesses that deal with the creation and selling of products. These businesses are usually wholesale distributors, manufacturers, and retailers. This insurance covers businesses from unforeseen costs connected to damages such as bodily injuries or harm caused by products, as well as expensive lawsuits.

• Business Interruption Insurance

Business interruption insurance is a type of insurance coverage designed for businesses that have physical locations. These businesses include manufacturing facilities and retail stores. It compensates income lost due to events causing disorder to the normal course of business. Generally, it is purchased as an additional coverage to business owners’ insurance policy and property insurance policy.

• Professional Liability Insurance

Unlike general liability insurance, which any business can take, professional liability insurance is made for businesses that offer services. It covers loss due to the service provided; it covers negligence, malpractice, or errors of negligence.

• Home-Based Businesses

Home-based businesses may need additional coverage for equipment and inventory. Generally, a standard homeowners insurance policy does not cover home-based businesses. In cases like this, you can add home-based business insurance to your homeowner’s insurance policy as additional coverage for a small amount.

• Vehicle Insurance

It is important to insure any vehicle you use for business, irrespective of type. Whether you use vans, tractor-trailers, buses, or passenger cars for businesses, you will need to get insurance to cover your car in case of any damages made as well as injuries to others.

How Much Does Commercial Insurance Cost?

Depending on several factors, how much business insurance costs is determined. These factors include your business type and the type of insurance coverage you want. For this reason, how much this insurance costs varies by lender and type of business. However, according to Progressive, the average monthly cost for commercial insurance is $759 and $55 according to Hartford.

What Affects My Commercial Insurance Cost?

Different factors affect how much business insurance costs. These factors include the number of employees your business has, your business location, business risks, and your preferred business type. The more coverage you require, the more expensive your insurance policy will be. However, commercial insurance costs are different from one state or region to another depending on the risk.

How to Get Commercial Insurance?

Business insurance can be gotten through insurance agencies that offer your preferred type of insurance policy. Another way to get it is by working with an insurance agent from an insurance company who provides you with insurance quotes and guides you through the application process and coverage options.

Aside from these, commercial insurance can be obtained online just by contacting an insurance agent. However, during this process, be sure to be careful and not fall for scams.