Do you need to cover a large expense, consolidate your existing debts, renovate your home, or refinance your car? Do you feel frustrated searching for places to apply for a loan? I can relate. Why not consider applying for a personal loan?

Generally, this type of loan is accessible through banks, credit unions, and online lenders. But what is a personal loan? This is the perfect guide for your question. Keep reading to find just what you need to know.

What Is a Personal Loan?

A personal loan is a type of loan that you can use for various personal expenses, such as consolidating debt, paying for home renovations, covering unexpected medical bills, or funding a vacation. Unlike specific loans like a mortgage or auto loan, where the money is designated for a particular purpose, a personal loan provides you with a lump sum of money that you can use as you see fit.

Personal loans typically have fixed interest rates and repayment terms, meaning you borrow a certain amount of money and agree to pay it back over a set period, often with fixed monthly payments. The interest rate and terms can vary depending on factors such as your credit score, income, and the lender’s policies.

When considering a personal loan, it’s essential to shop around and compare offers from different lenders to find the best terms and interest rates that suit your financial situation.

Types of Personal Loans

There are various types of personal loans that are designed to meet different financial needs and situations. Here are some types of personal loans:

- Secured personal loans

- Unsecured personal loans

- Variable-rate loans

- Payday loans

- Medical loans

- Co-sign loans

- Fixed-rate loans

- Debt consolidation loans

- Installment loans

- Personal line of credit

To repeat, all of these loans serve different financial purposes and meet different needs as well.

How Does It Work?

Personal loans come in different types and can be secured or unsecured. As for a secured personal loan, you will need to put up an asset or collateral to secure the loan. This is to give the lender security in case you are unable to pay back the loan. This means default will cause the lender to seize the collateral. Some examples of secured personal loans include auto loans and mortgages.

On the other hand, unsecured personal loans do not require collateral or assets. Therefore, even if you are not able to pay back the loan, the lender will not have control over your property or assets. But keep in mind that there will be consequences. For instance, if you fail to pay back an unsecured loan, it can affect your credit score.

Nevertheless, personal loans are usually paid as a lump sum and will be transferred to your account. You will also need to pay it back over a fixed period. The payback period for personal loans is usually as short as one year or as long as 10 years, depending on your lender.

Pros and Cons

What are the benefits and drawbacks of applying for a personal loan? These are important details that you need to pay attention to and juxtapose before applying for this loan type. Here are some of the good and discouraging sides of a personal loan:

Pros

- No collateral is necessary.

- Speedy funding.

- Fixed payments and interest rates.

- Flexibility

- Lower interest rates.

- Consolidate debt.

Cons

- Fees and penalties.

- There are no tax benefits.

- High interest rates for poor credit borrowers.

- Stringent requirements.

- Debt potential.

- Not the best option for emergencies.

Reflect on the advantages and disadvantages and relate them to your financial needs and situations to find the best rates and terms for you.

When Are Personal Loans a Good Idea?

Unquestionably, personal loans are helpful financial tools used in different situations. However, it is important to know the best time or situation to apply for this type of loan. So, who would want a personal loan? Here is what you can use a personal loan for:

- Large purchases.

- Debt consolidation.

- Medical bills.

- Tax bills.

- Home improvements.

- Funeral costs.

- Emergency expenses.

- Medical emergency.

- Moving costs.

- Wedding expenses.

- Vehicle financing.

- Vacation costs.

Hence, if you are planning any of the things mentioned above, what are you waiting for? Apply for or take out a personal loan today.

How to Apply for a Personal Loan

The application process for a personal loan differs between lenders and financial institutions. But if you have the right steps to guide you, you won’t have any problem performing any type of application procedure, no matter the lender. Here is a straightforward guide to help you carry out this process:

- Review your credit score.

- Make out your needs.

- Look for potential lenders.

- Prequalify.

- Prepare the important documents.

- Begin and submit your application.

- Wait for approval.

- Review the offers.

- Check the loan terms.

- Accept the loan.

- Receive funds.

Once you have gotten the funds, you can start repaying the loan. However, make sure that you do not default and make payments on time. In addition, understand the terms and read reviews before choosing.

Where to Find Personal Loans

There are many sources from which you can obtain a personal loan. What’s more, these sources provide different benefits, interest rates, and terms. Here are some of the best places to shop for personal loans if you are interested in taking out one:

- Marketplace Finders

- Banks

- Online Lenders

- Credit Unions

- Peer-to-peer lending platforms

Using these options, you will be able to get any type of personal loan, even if it takes a lot of time to explore them.

FAQs

What are the eligibility criteria for a personal loan?

Eligibility criteria typically include factors such as your credit score, income, employment status, and debt-to-income ratio. Lenders use these factors to assess your ability to repay the loan.

How much can I borrow with a personal loan?

The loan amount you can borrow depends on various factors, including your credit history, income, and the lender’s policies. Generally, personal loan amounts range from a few hundred to several thousand dollars.

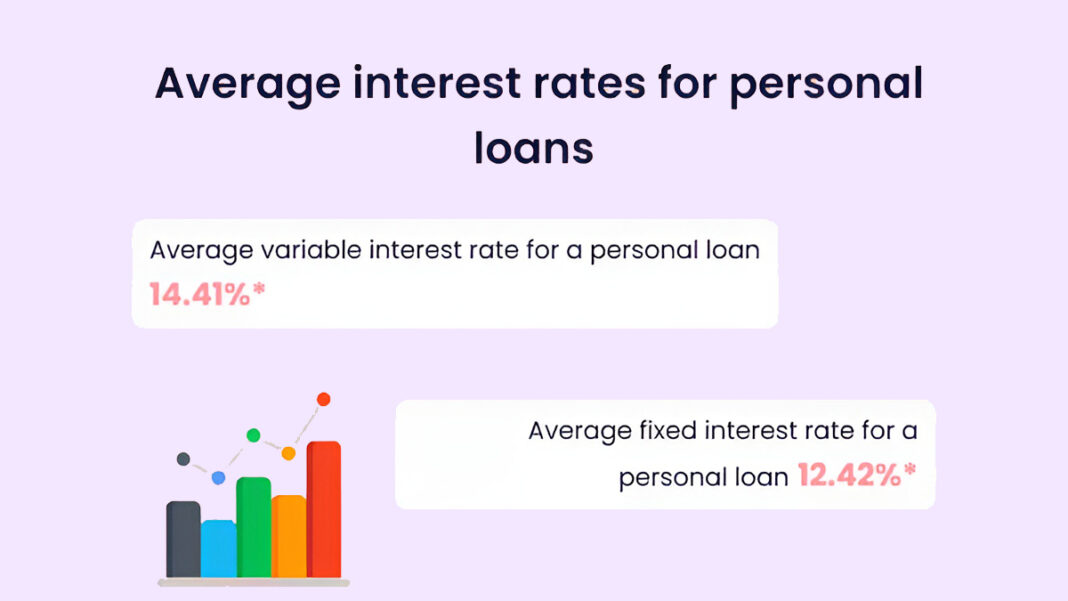

What is the interest rate on a personal loan?

Interest rates on personal loans can vary widely depending on the lender, your creditworthiness, and prevailing market rates. It’s essential to compare rates from different lenders to find the most competitive offer.

What is the repayment period for a personal loan?

Repayment periods for personal loans typically range from one to seven years, although some lenders may offer shorter or longer terms. Choosing the right repayment period depends on your financial situation and how quickly you can afford to repay the loan.

How long does it take to get approved for a personal loan?

The approval process for a personal loan can vary depending on the lender and your application. Some lenders offer instant approval, while others may take a few days to process your application and make a decision.

What should I consider before taking out a personal loan?

Before taking out a personal loan, consider factors such as the interest rate, fees, repayment terms, and how the loan will affect your overall financial situation. It’s essential to borrow responsibly and only take out a loan if you can afford to repay it.