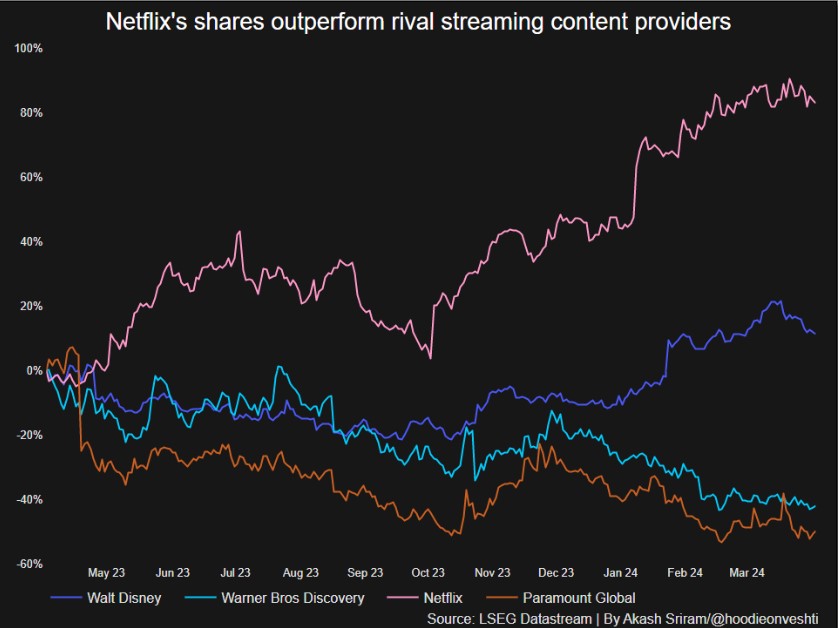

Netflix shares declined on Friday following the announcement of its intention to cease sharing subscriber numbers starting in 2025, sparking concerns about its future growth trajectory. Analysts cautioned that this move, which could prompt rivals to follow suit and abandon this key metric, could obscure insights into the streaming industry’s health.

Traditionally, investor attention has been closely tied to subscriber additions as a gauge of performance for companies like Netflix, Walt Disney Co, and Warner Bros Discovery amidst the ongoing streaming wars. However, Netflix, after experiencing three quarters of robust subscriber growth, revealed its decision to prioritize revenue and profitability over subscriber figures.

Dan Coatsworth, an investment analyst at AJ Bell, noted, “Industries tend to work in unison and if one of the leading players decides it is better that investors judge performance on different measures, rivals might adopt the same logic.”

This decision arrives amid concerns about how Netflix plans to sustain growth post-implementation of its password-sharing crackdown, which significantly boosted first-quarter customer additions. Data from research firm Antenna in February suggested a slowdown in streaming growth in the U.S., raising questions about Netflix’s growth potential in the current market landscape.

Netflix’s stock experienced a 7.3% decline to $565.85, marking its largest drop since July, as its second-quarter revenue forecast fell short of estimates. If sustained, this drop would result in an approximate $19 billion decrease in market valuation.

In response to growth challenges, Netflix aims to enhance the variety and quality of its content and expand its advertising business. Wolfe Research suggested that Netflix might venture into bidding for NBA media rights, signaling a departure from its previous focus on sports entertainment content such as the Formula One docu-series ‘Drive to Survive’ and WWE.

“Netflix leaps from subs to engagement (and less disclosure) at a pivotal moment: the NBA’s media rights sale. Will Netflix spend $1-3B for some of the NBA’s media rights? We think so. Sports is the biggest slice of the pay TV pie, and Netflix can accelerate sports brands’ globalization,” Wolfe Research commented.