Purchasing a home is often considered one of life’s biggest milestones. It is a significant financial decision that requires careful planning and consideration. While many dream of homeownership, navigating the mortgage process can be daunting and overwhelming. However, by learning from the experiences of homeowners who have made costly mistakes, prospective buyers can avoid common pitfalls and ensure a smooth mortgage journey.

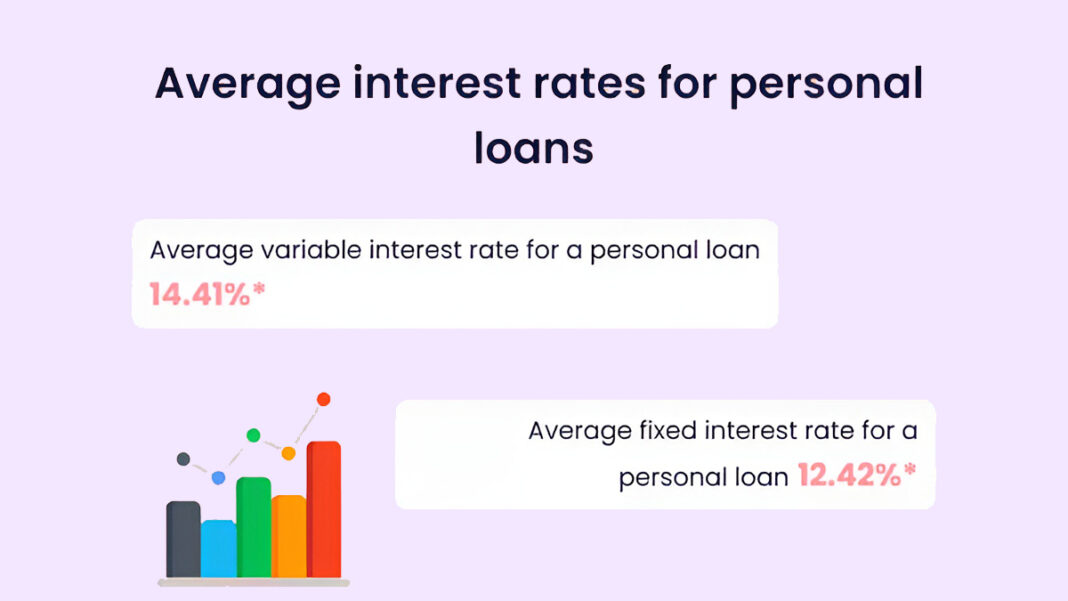

One of the most common mistakes homeowners make is failing to shop around for the best mortgage rates and terms. It is essential to compare offerings from multiple lenders to find the most favorable loan option. Many borrowers make the mistake of settling for the first lender they encounter, thinking it is too time-consuming or stressful to explore other options. However, dedicating time to research and negotiating with lenders can save thousands of dollars in interest payments over the life of the loan.

Another critical mistake to avoid is overestimating one’s budget. It is crucial to determine a realistic price range based on personal finances and financial goals. Homebuyers often make the mistake of stretching their budget to purchase a larger or more luxurious home, only to find themselves struggling to meet monthly mortgage payments. Carefully assess income, expenses, and long-term financial plans to ensure that the chosen mortgage is affordable and sustainable.

Inconsistent credit monitoring is another common mistake homeowners often regret. Your credit score plays a significant role in obtaining a mortgage with favorable terms. Hence, it is vital to regularly check credit reports for inaccuracies and take steps to improve credit health before applying for a mortgage. By addressing any issues and improving creditworthiness beforehand, borrowers can secure more favorable interest rates and terms, saving them significant sums of money over time.

Homebuyers should also pay close attention to the terms and conditions of the mortgage being offered. For instance, some mortgages may have penalty fees for early repayment or substantial charges for missed or late payments. Others may have adjustable interest rates, causing mortgage payments to spike unexpectedly. Reviewing and understanding all aspects of the mortgage agreement, seeking legal advice if necessary, can help prevent being blindsided by unfavorable terms and prevent future financial strain.

Failure to establish an emergency fund is yet another mistake that prospective homeowners should avoid. Unexpected expenses can quickly mount up, such as repairs, renovations, or a sudden loss of income. Without a financial safety net, homeowners may find themselves unable to meet mortgage payments, leading to late fees, damaged credit, or even foreclosure. It is recommended to set aside three to six months’ worth of living expenses in an emergency fund to protect against unforeseen circumstances.

Lastly, overlooking the importance of a thorough home inspection prior to purchase can result in costly surprises down the road. Homebuyers should avoid relying solely on the seller’s disclosure statement and engage a professional inspector to evaluate the property’s condition. Identifying any potential issues, such as structural problems or hidden damages, can save homeowners from significant financial burdens in the future.

Recognizing and learning from the mistakes made by others can be immensely valuable in avoiding costly missteps throughout the mortgage process. By shopping around for the best rates, establishing a realistic budget, monitoring and improving credit, carefully reviewing mortgage terms, setting up an emergency fund, and conducting a thorough home inspection, prospective homeowners can ensure a seamless mortgage journey and enjoy the benefits of homeownership without unnecessary financial burdens.